Overview

|

|

While financial institutions are trying to get back to pre-recession return on investment (ROE) levels, the market, on the other hand, has been evolving through the adoption of digital technology in the banking services. This, coupled with a hyperactive regulatory environment is forcing these institutions to comply with a continuously expanding set of policies, leading to rising costs across geographies, and altered product dynamics.

Financial institutions are therefore looking for secure banking solutions through which they can keep costs low while continuing to streamline operations to stay relevant in the market.

What we can do for you?

Brindley Technologies provides comprehensive offerings across all retail banking and corporate banking functions, such as: Consumer Lending, Commercial and Corporate Lending, Cards, Trade Finance, Multi-Channel Banking, Treasury, Cash Management, anti-money laundering, retail banking and Core Banking, and provides business and technology consulting, domain-led development, migration, maintenance and testing, and applications portfolio rationalization. Our retail finance solutions are domain-driven, technology-agnostic and risk-aware alternative banking IT solutions that have been developed by highly competent business practitioners, supported by industry leading proprietary knowledge frameworks such as Brindley Technologies, Business-Benefits Realization and other banking systems software based on experiential scientific mechanisms geared towards delivering guaranteed benefits.

Why should you consider us?

Proven experience in conceptualizing and realizing industry-benchmarked value delivery models – from staff augmentation, to build-operate-transfer specifically for banking customers

Strategic partnerships with leading banking software solution firms such as SAP, Misys, Microsoft, IBM, and Oracle to deliver unparalleled domain, industry, and technology expertise

More than 50+ customers in the banking vertical with a high rate of repeat business reflecting a highly satisfied customer pool

Extensive experience in building solutions that are industry redefining in nature, through unique partnership models. For example, HCL has been running a highly successful Joint IP ownership program with a leading U.S. financial institution.

People, Partnerships and Capability

Many IT experts serving leading banking organizations across the globe

Many highly experienced domain consultants with extensive banking operations experience

Many Subject Matter Experts across micro verticals and focus areas

Serving retail banks in all major geographies

Driving the innovation program of a leading Fortune 50 financial firm by way of setting up and managing its state-of-the-art Innovation Lab

Partnering and managing innovation initiatives for many large financial institutions across the globe

Building next gen banking service propositions under the- “Banking Center of Excellence” project, with a leading global software services provider

Highly successful in conceptualizing and realizing consortium models to deliver high impact IT solutions

Strong horizontal partnerships in SMAC (Social, Mobility, Analytics and Cloud) with industry leading software vendors

Over 100+ mobility projects successfully delivered

360 degree partnerships with leading banking software vendors

Digital partners for over 20 large enterprises

Offerings

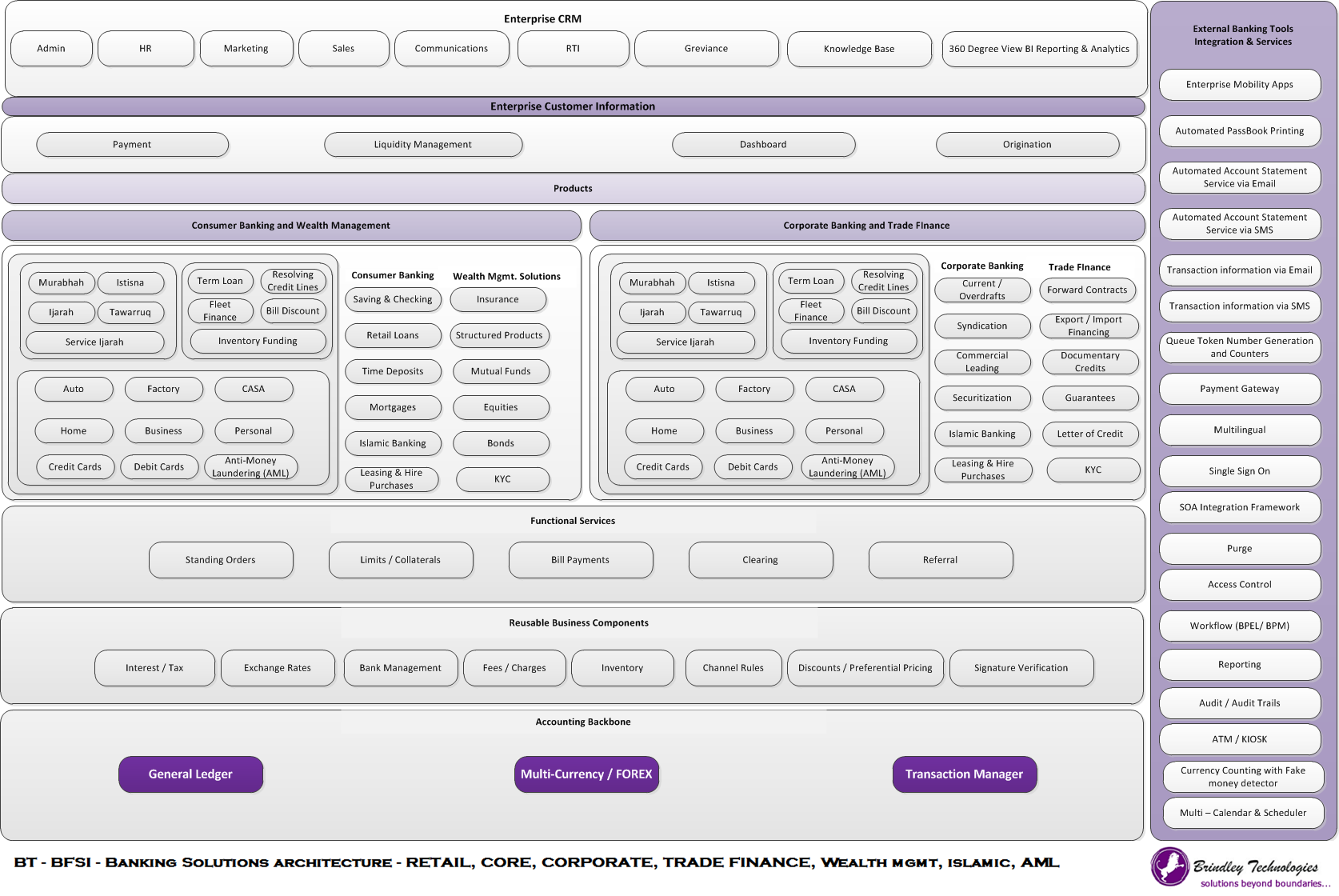

BridleyTech’s Custom Core Banking Solutions Application Stack

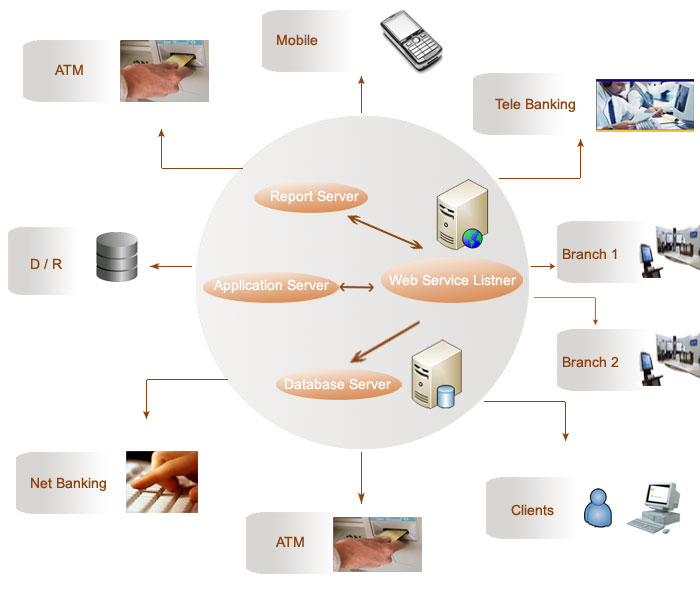

As an Systems Integrator, we providing systems integrated application [COTS, NON COTS – Products], BPM business process and infrastructure solutions, services and products that are designed to help our core banking clients meet their most pressing business and technology needs. Our deep insights experience in banking have helped our clients positively impact their results, business models and growth strategies.

Some of the areas where we specialize in Banking domain are:

Retail Banking & Lending, Corporate /Commercial Banking and Lending, Anti-Money Laundering (AML), Retail Banking, Investment Banking, Loan, Lease, Credit Cards, Deposit CASA, Deposit Term Deposit, Clearing, Teller, Corporate Banking, Lending Loans, Inventory Funding, Lending Bill Discounting, Lending Fleet Financing, Transaction Banking – Global Receivable Management, Global Payment, Global Liquidity Management, Financial Supply Chain Management & Islamic Banking and multi-geographic and culture banking services and products, Integration with banking regulatory, integration with other banks and systems.

|

Industries

RESOURCES & CASE STUDY

Brindley Technologies and its subsidiaries –

Services Catalogs, brochures can be found at Resources section – Services Catalogs.

Product Catalogs, brochures can be found at Resources section – Product Catalogs.

Case Study, brochures can be found at Resources section – Case Study.

Industry specific solutions, brochures can be found at Resources section – Industry specific solutions.