Overview

|

|

The Financial Services, capital markets and asset management landscapes have been significantly transformed since the global financial meltdown. A slew of regulations governing Capital market activities have considerably raised compliance effort and risk. The cost-to-income ratio continues to be under pressure, instilling an organization-wide need for cost discipline. There has also been a paradigm shift in customer expectations as they demand a faster “time to relationship”. Thus, global investment managers and bankers are making their services ambidextrous in order to include up-stream and down-stream activities in the service value chain to deliver a “know me” customer experience.

what we can do for you?

Brindley Technologies can provide point solutions as well as end-to-end domain solutions leveraging a vast partnership eco system and proprietary solution accelerators in the key capital market functions of Asset Management, Wealth Management, Risk and Compliance, Investment Banking, Exchanges, Securities and Fund Services.

Business aligned IT approach

Brindley Technologies IT solutions for capital markets are aligned to address business imperatives through a renewed focus on rationalizing and converging IT and Operations across regions and asset classes while maintaining regulatory compliance and reporting. It is a constant endeavor to industrialize service delivery, standardize and centralize to reduce cost and risk with the help of next generation capital market applications and IT services.

Improving performance by nurturing relationships

Brindley Technologies long-standing transformational relationships with leading financial services, capital markets and asset management players across the world is a testimony of our commitment to deliver exceptional service quality and to take every customer relationship beyond the contract in its true spirit. Brindley Technologies service delivery model has built-in tools to measure service quality in light of customer expectations and deliver continuous service improvements. All capital market engagements have multi-tiered governance, with domain solution principles on board, to safeguard the tactical, operational and strategic interests of customers.

Building scalability through investments and partnerships

Brindley Technologies collaborates closely with best-of-breed partners – technology, product, and consulting firms, to deliver unique value to customers through our combined strengths. Brindley Technologies invests in building rewarding partnerships with players in the capital markets landscape:

COTS partners – Avalgo

Technology partners – SAP, Oracle,SAS

Consulting partners – AGC Networks, a consulting arm of Brindley Technologies Applications and Infrastructure teams to uncover complex insights

Addressing future needs through Thought Leadership

Brindley Technologies understands the fast changing dynamics of the capital markets sphere and is well poised to address all its business challenges with the help of new and innovative capital market applications.

Proactive workload reduction is very important to optimize system performance and maintain cost discipline. To this effect, Brindley Technologies measures its application services through business KPIs

Brindley Technologies has a full suite of services to provide the maximum synergies to customers through integrated IT service delivery, operations, and infrastructure.

Taking centralization and standardization to the next level, Brindley Technologies can create ‘internal utilities’ with a potential for scalability and commercialization.

Brindley Technologies can provide digital system integration, enabling better decisions, intuitive products and services, and better throughput across the value chain.

Offerings

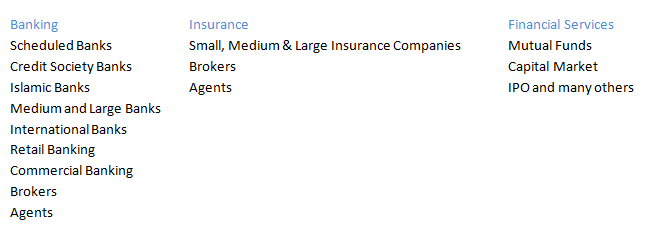

As an IT systems integrator, we have a very good domain understanding in the Financial Service Industry. Our client range from investment banks to asset managers, retail brokers to custodians, financial information providers to industry regulators like RBI, IRDA and many others, Bit coin, Mutual Funds, Equity, Bonds, Derivatives, Capital Market, Trade, Commodity Market and many others. The innovative solutions provided by us enables our customers to respond to market changes, develop profitable customer relationships, and secure new opportunity to stay ahead of competition. We provide systems integrated SOA based [COTS & NON-COTS Products, BPM] solutions on various platforms and devices.

Why should you consider us?

Brindley Technologies capital market services group is the largest micro vertical under the BFSI vertical. With a deeply entrenched innovation and pioneering spirit, the practice has several ‘firsts’ to its credit:

First to handle the capital markets outsourcing operations for a leading investment bank

First to set up Issuance and Paying Agency functions for a world leading Trust

First to set up an offshore based delivery model to handle derivatives documentation and review

A leader in Global Markets front office sourcing

A pioneer in building and transitioning operations to an East European location for a global custodian

|

Industries

RESOURCES & CASE STUDY

Brindley Technologies and its subsidiaries –

Services Catalogs, brochures can be found at Resources section – Services Catalogs.

Product Catalogs, brochures can be found at Resources section – Product Catalogs.

Case Study, brochures can be found at Resources section – Case Study.

Industry specific solutions, brochures can be found at Resources section – Industry specific solutions.