Overview

|

Every Insurer faces internal challenges in relation to the productivity of their agents, producers, brokers, and employees, and to stay competitive out in the market, they need to reduce the cycle time for their product launches, improve their customers’ experience, and reduce the time, cost and effort in administering their policy transactions. In addition, they also need to proactively detect and prevent fraud, manage claims processes faster and adhere to risk and regulatory compliances to avoid paying penalties.

|

What we can do for you?

Brindley Technologies offers insurance software services and business-driven technology solutions that help Insurers overcome these challenges. Our in-depth knowledge, extensive insurance industry experience, domain competency, technology, proprietary tools, methodologies and frameworks, coupled with a value creation model is helping many global and regional insurance leaders to profitably improve their business.

Offerings

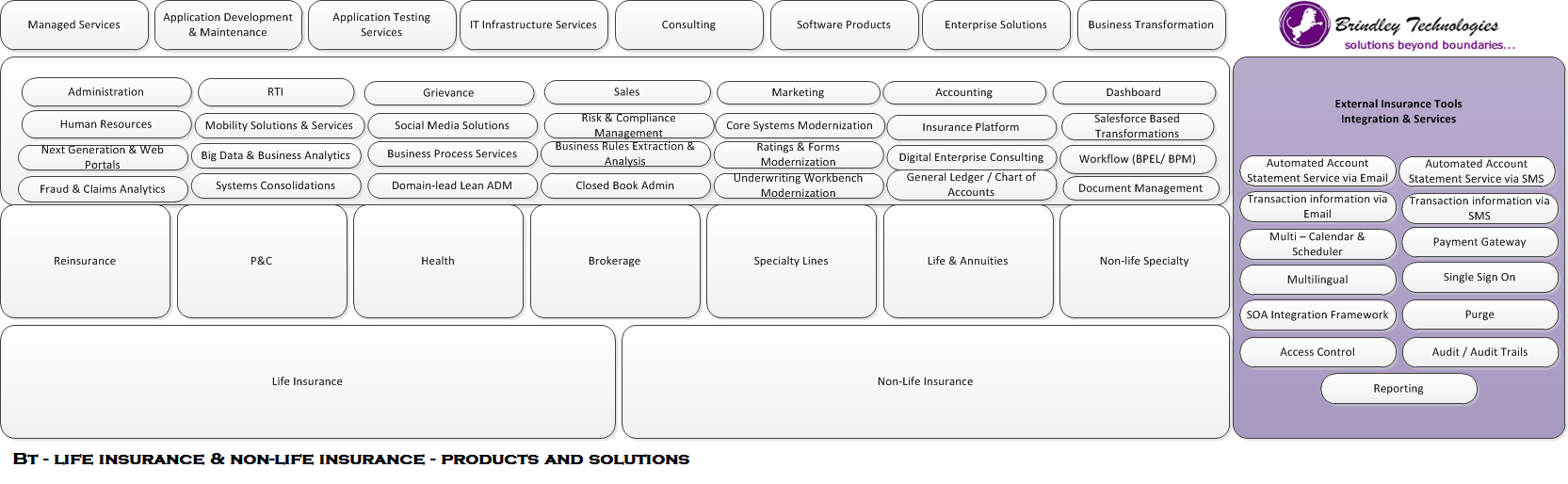

BridleyTech’s Custom Insurance Solutions Application Stack

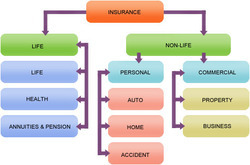

As an Systems Integrator we understand that “Insurance” business is very competitive, strike regulator pressure to implement rules define and modified continuously. In order to stay ahead of the game, we help insurance companies to transform their process and operations, reduce cost and meet the ever growing need for improved customer services by providing next generation SI solutions with SOA based architecture that allows deployment of complete end-to-end solutions. Some of the features of our solutions are New Business, Quotes, Claims, Commissions, Reinsurance, Billing & Accounting, Customer Care Services, Grievances, Brokerages, P&;;C, Marketing, Sales & tele-marketing, Core Insurance Product, Accounting & Financial Systems, Administration, marketing, Agent Management, Rajbhasa, RTI, Integration with Insurance Regulatory and many other systems.

We provide complete end-to-end SOA based systems integrated insurance [COTS & NON-COTS] solutions & support and maintenance of the systems to our customers.

What we offer?

Micro-vertical Services

Life Insurance and Annuities

Property and Casualty/ General Insurance

Business Services

Actuarial Services

Niche Services

New Product Introduction

Building Flexibility through Enhancements and Simplification

Insurance Services:

Insurance Consulting, Development, Maintenance, Testing and Application Portfolio Optimization

Outsourced model, managed services, co-sourced managed services, project execution, co-sourced time and materials, transformation projects

Collaborative working model supported by Governance platforms, helping clients gain complete visibility of their projects executed across locations and regions across the globe

Agile methodology and tools to remove distortions and gaps in understanding business and technology alignment; Insurance solutions with zero-deviation

Partner product implementations and services; building co-innovation labs

Why should you consider Brindley Technologies?

Business Aligned IT Approach: Although Insurers have a common objective of enhancing intrinsic value for customers, they face all of the typical challenges. Brindley Technologies unique approach can help resolve these challenges. It involves an integrated suite of insurance IT systems, and employs and leverages industry professionals with local industry business knowledge and technology experience, to provide the best options and best fit solutions while considering the associated impact.

Improving performance by nurturing relationships: Post the recession, Insurers are working with a select set of IT players and insurance IT and insurance software services. This has helped them to contractually agree with specific quantifiable measurements (SLAs, operational level agreements), and significantly reduce cost. Brindley Technologies has a client retention score of 98% and a client reference score of 4 which is the highest in the IT Industry. Our clients repeatedly select us to continue as their only Insurance solutions IT partner, and some of the top insurance clients have selected Brindley Technologies as one of their Top 3 preferred partners.

Building scalability through investments and partnerships: Understanding the unique challenges and needs of Insurers, Brindley Technologies has made significant investments in:

Centers of Excellence (CoE) / Labs (partner capabilities): Building CoEs to develop partner product expertize, technical expertise such as Guidewire, eBaoTech, SFS, SAP, MS Dynamics, SFDC, PEGA, and more.

Centers of Excellence (CoE) / Labs (client needs): Collaborating with customers to proactively identify needs on specific products/applications/technologies. Brindley Technologies has labs (innovation, mobility, testing, and others) and built dedicated CoEs for one of the Top 10 IT services firms in India, and a global management consulting, technology services and outsourcing company.

Developing accelerators/tools/POCs/frameworks: Some of these Brindley Technologies assets are specific to insurance business processes and include over 10,000 test cases, assessment tools, and omni-channel frameworks for P&C Insurers, knowledge exchange platforms for underwriters specially designed for commercial specialty Insurers, and agent applications specific to the Life & Annuity insurance business.

Addressing future needs through Thought Leadership: Brindley Technologies observes key digital trends that are likely to disrupt the Insurance market. As a digital transformation partner for leading Insurance companies that are going digital, Brindley Technologies has built a complete set of propositions covering the end-to-end digital needs of today’s global Insurance enterprises.

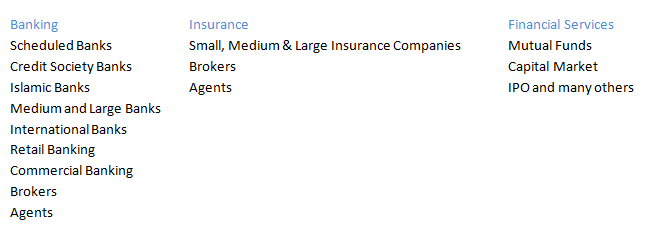

Industries

RESOURCES & CASE STUDY

Brindley Technologies and its subsidiaries –

Services Catalogs, brochures can be found at Resources section – Services Catalogs.

Product Catalogs, brochures can be found at Resources section – Product Catalogs.

Case Study, brochures can be found at Resources section – Case Study.

Industry specific solutions, brochures can be found at Resources section – Industry specific solutions.